What & Why?

Financial Planning, or more broader and undoubtedly connected, Financial Planning and Analysis (FP&A), is the process of company-wide Budgeting, Planning and Forecasting of expenses and income that allow to anticipate the future result. In this process, financial and operational data are combined to help align business processes and strategies with financial goals, and to continuously evaluate the progress towards those goals.

These software solutions used to be referred to as Strategic Corporate Performance Management Solutions but more recently Financial Planning and Analysis seems to become the new software solution market name, with a corresponding Gartner Magic Quadrant.

Three words are important in this domain: Planning, Budgeting and Forecasting. It is important that these terms are being used in the correct context.

Planning predicts the company's financial direction and creates a model of expectations for the mid to long term. It can be seen as a strategic prediction of business performance at a summary level with a time horizon between 3 to 5 years. Budgeting should be considered as a traditional fiscal calendar year based forward looking process. This 12-months financial outlook is most of the time a very time-consuming bottom up process where all departments of the company contribute. Forecasting is typically done when a revision of the budget is needed because of changed short-term events that impact the business. The use of historical data is key in this process and serves as a prediction for the future months. The budget is a plan for where a business wants to go, while a forecast is the indication of where it is actually going.

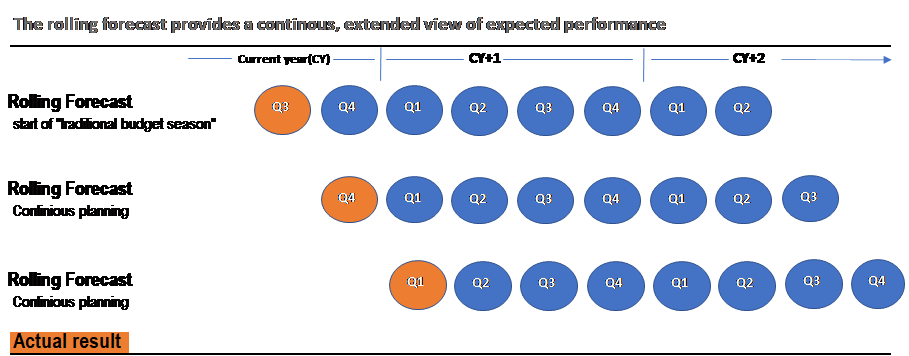

More and more companies adopt a continuous estimation of future financial results, which we can summarize as rolling forecast. That rolling forecast can cover from 12 months rolling up to 24 months rolling, depending of the nature of your business. Even more, that rolling process can even cover multiple years if you think about companies in the spatial business. Retail business might plan very granular the first three months, even on weekly basis, rolling then into monthly forecasts.

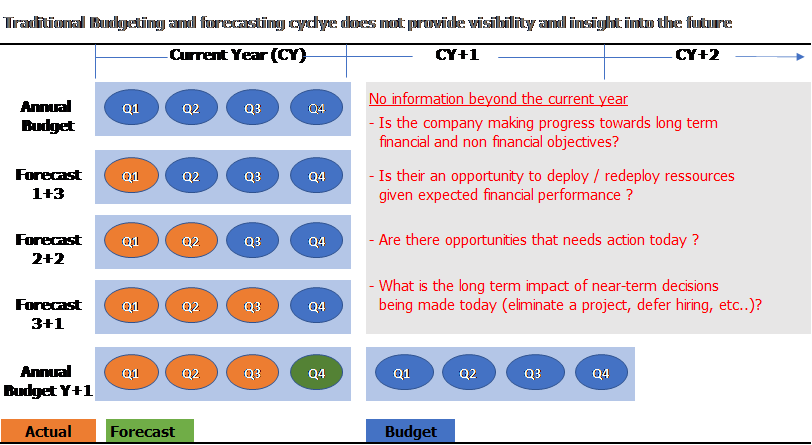

Rolling forecast is a management tool that enables companies to continuously plan over time and allows an extended view of expected performance. It is a driver-based process that allows faster planning and consumes less financial resources. The picture below describes a classic planning cycle where the annual budget is revised three times in the year.

A rolling forecast approach, briefly described in the next pricture, is carried out on a more permanent and structered basis, resulting in higher accuracy and performance of that process. Secondly, it will create more awareness on drivers and KPI’s being used for the basis of the forecast and thirdly, the projections are constantly revised allowing a more precise match with business reality.

How can we help?

Next to the availability of the required technology and solutions, it is equally important to provide the functional process knowledge with a multidisciplinary team.

Through our vast experience and expertise, our specialists from element61 are offering our customers the opportunity to challenge their existing planning processes. That is a key differentiator at element61. We offer a good mix of technology and functional expertise. As the proof of the pudding is in the eating, have a look at these interesting Customer case studies on Planning, Budgeting and Forecasting (PBF).

Our PBF Software Portfolio

SAP Business Planning and Consolidation

Streamline planning and achieve a faster, more accurate close with SAP BPC software. Spend more time growing your business and less time closing the books – with SAP Business Planning and Consolidation. BPC software delivers planning, budgeting, forecasting, and financial consolidation capabilities in a single application. Easily adjust plans and forecasts, speed up budget and closing cycles, and ensure compliance with financial reporting standards. Click here for more information.

SAP Analytics Cloud for Planning

SAP Analytics cloud allows collaborative enterprise planning, eliminating the silo approach where each department or unit individually plans without a view on common strategic targets. This SaaS cloud-based technology combines enterprise planning capabilities with business intelligence and augmented analytics.

Click here for more information.

The Tagetik platform offers budgeting, forecasting and planning, consolidation and close, disclosure management and compliance, internal and external reporting, and workflow and process management. The platform comes in an on-premise solution as well as a cloud-based platform.

Click here for more information.

Vena Solutions is an intuitive budgeting, planning and forecasting software for small, medium and large sized organizations. Vena’s financial planning and analysis (FP&A) solution embraces Microsoft Excel technology and turns it into an enterprise cloud solution with centralized database, sophisticated workflow, powerful reporting and advanced analytics.

Click here for more information.

IBM Planning also known as TM1 integrates business planning, performance measurement, and operational data to enable companies to optimize business effectiveness and customer interaction regardless of geography or structure. Planning Analytics provides immediate visibility into data, accountability within a collaborative process, and a consistent view of information, allowing managers to quickly stabilize operational fluctuations and take advantage of new opportunities.

Click here for more information.