Enhancing Construction Project Profitability for Real Estate Developers

Introduction

Real estate development is a complex and lengthy process, involving the transformation of land into profitable ventures such as rental properties, condos, or commercial sites. Unlike many businesses where profits can be quickly realized, real estate developers often wait years to see returns on their investments. This extended timeline necessitates a strategic approach to ensure ongoing profitability amidst changing market conditions.

Key Strategies for Maximizing Profitability

Comprehensive budget planning is crucial for assessing the feasibility of a project. Developers must account for both hard and soft costs to ensure that anticipated profits exceed these expenses. Hard costs encompass construction-related expenses such as labor, subcontractors, land acquisition, and building materials, while soft costs include non-construction expenses like architectural and engineering services, design, legal fees, financing, and administrative costs.

Continuously monitoring the market is vital. Developers need to stay vigilant about economic conditions, interest rates, inflation, and local market trends. Regular assessment helps in adjusting strategies to maintain profitability. Unforeseen challenges, such as permit delays, supply chain issues, or labor shortages, can significantly impact timelines and budgets, necessitating adaptive planning.

Utilizing key financial metrics can provide deeper insights into project viability and profitability. Net Present Value (NPV) measures the difference between the present value of cash inflows and outflows over time, helping to evaluate project feasibility. Net Operating Income (NOI) reflects the annual income after operating expenses, excluding debt service and capital expenditures, which aids in comparing potential profitability across projects. The Internal Rate of Return (IRR) assesses the annualized rate of return on investment, guiding decisions on whether to proceed with a project. The Capitalization Rate (Cap Rate) is the ratio of NOI to property value, offering insight into return rates relative to risk. The Profitability Index (PI) evaluates the potential profit by comparing the present value of future cash flows to the initial investment, helping prioritize projects.

Maintaining Profitability During Development

Maintaining profitability during the development phase requires adaptability to market changes. Developers must be prepared to adjust project plans in response to fluctuating market conditions, which might involve altering budgets, timelines, or even the project's scope to ensure financial viability. Regular reporting and scenario analysis help anticipate changes and make informed decisions.

Effective cash-flow management is essential to track costs at every stage of the project. Detailed cash-flow planning ensures that expenses align with projected budgets and helps secure the necessary funding from lenders. Continuous monitoring allows developers to adjust financial strategies as needed to maintain healthy profit margins.

Scenario analysis and cost projection are also critical. Scenario analysis enables developers to anticipate the impact of various factors, such as interest rate changes or fluctuating market demand, on project profitability. Accurate cost projections and regular updates are vital for maintaining financial control and ensuring that the project stays within budget.

Tracking costs and forecasting future expenses have traditionally been complex for finance teams in real estate firms. Without the right planning tools, they face several challenges:

- Time-Consuming: Modeling various scenarios and updating data manually is labor-intensive, making it difficult to respond quickly to market changes. For example, Kyli mentioned using an extensive workbook for scenario modeling, which led to confusion with multiple saved versions.

- Lack of Agility: Construction budgets managed solely in Excel can quickly become outdated as new costs arise and market conditions change, hindering timely decision-making. Kyli recalled how a significant expense booked last minute rendered her data outdated for a presentation.

- Risk of Human Error: Manual data manipulation increases the chances of inaccuracies and errors, compromising the visibility and tracking of actual project spending. This can lead to difficulties in maintaining accurate cost assessments throughout the project.

Leveraging Technology for Improved Planning

Implementing a comprehensive planning solution like Vena can streamline budgeting, cash-flow planning, and scenario analysis. These tools integrate data from various sources, providing a centralized and up-to-date view of project finances. Advanced planning platforms facilitate more accurate and efficient decision-making, helping developers remain agile and responsive to market changes.

Conclusion

Maximizing profitability in real estate development requires meticulous planning, continuous monitoring, and adaptability to changing market conditions. By employing detailed budget planning, leveraging key financial metrics, and utilizing advanced planning tools, developers can enhance their ability to deliver profitable projects. Integrating comprehensive planning solutions ensures that developers have the necessary tools to stay informed and make strategic decisions, ultimately driving project success and financial returns.

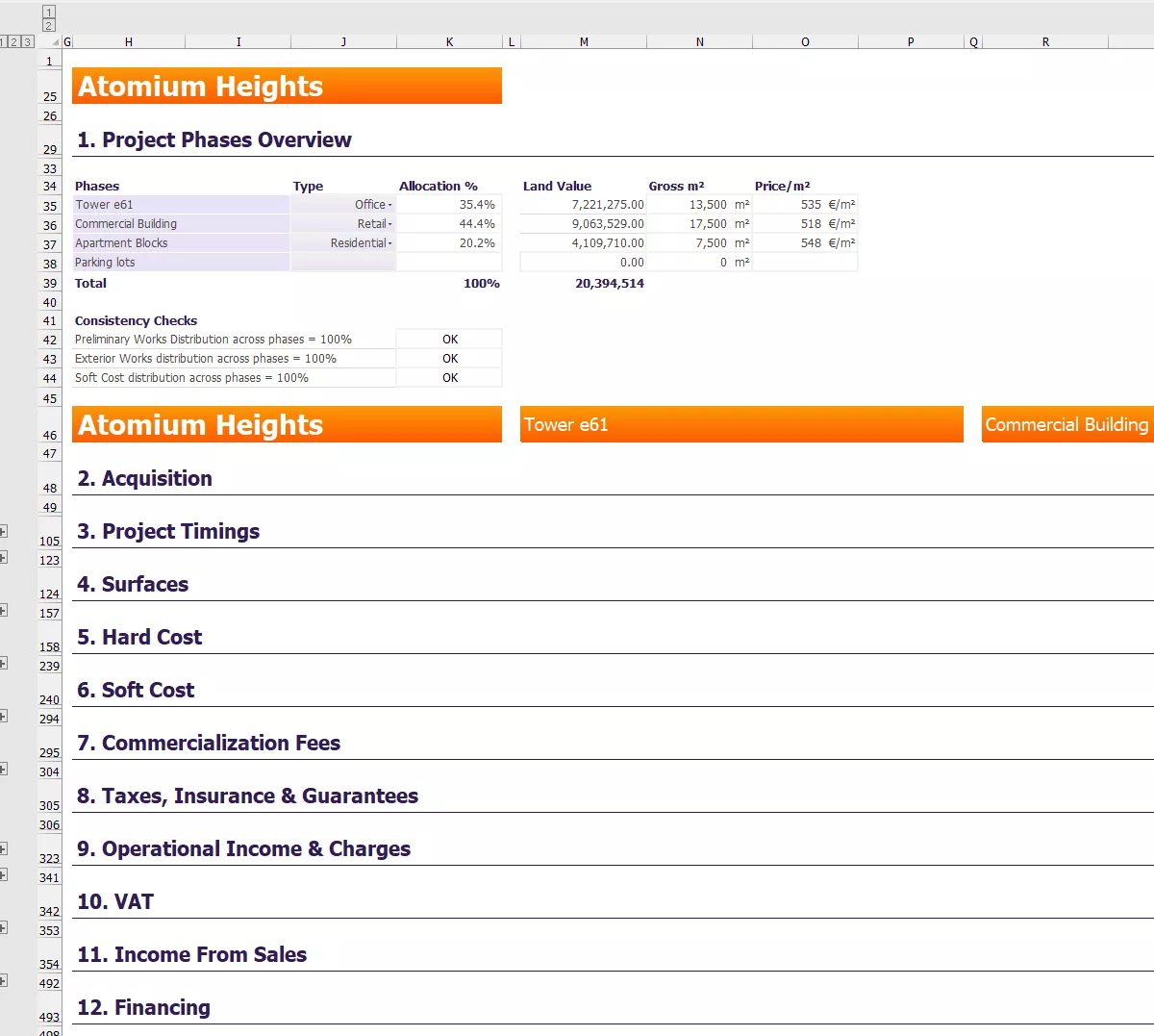

With the Real Estate starter kit from element61, powered by Vena’s planning and reporting engine, you get access to pre-built workflows, data entry templates and reports.

Solution screenshots

Project feasibility template - general view

Project feasibility template - acquisition

Project feasibility template - project timing