"Who is likely to churn?"

Imagine that you can know which customer is planning to leave. It would allow you to more smartly deliver marketing spend and thus save significant costs; the cost to acquire a customer is actually 5 times bigger than the cost to retain a customer.

Invest in retaining your existing customers. It is therefore crucial to focus your attention on customers who are most likely to stop buying from you (i;e. churn). But how do you determine those customers? This is what we mean deliver with churn prediction.

What's Churn Prediction

Churn Prediction is the process of predicting and identifying customers who are likely to churn (leave, stop buying) within X months. It’s proven to be a tangible use-case that often brings direct ROI to the business: e.g. Churn scores can be automatically added in e.g. Sales Force Automation tools or CRM systems and leveraged by sales or call center agents. By focusing on those customers, your retention budget can be spent in the best way possible.

Biggest learnings

From our experience, Churn is often highly driven by Recency, Frequency, and Monetary value (RFM).

What do we understand with these measures:

What do we understand with these measures:

- Recency: how recently did the customer purchase?

- Frequency: how frequently does the customer purchase from us?

- Monetary value: how much does the customer spend?

However, in order to make more accurate predictions, we have seen a great impact of augmenting those dimensions with other drivers like seasonality, promotions and general ordering patterns of customers.

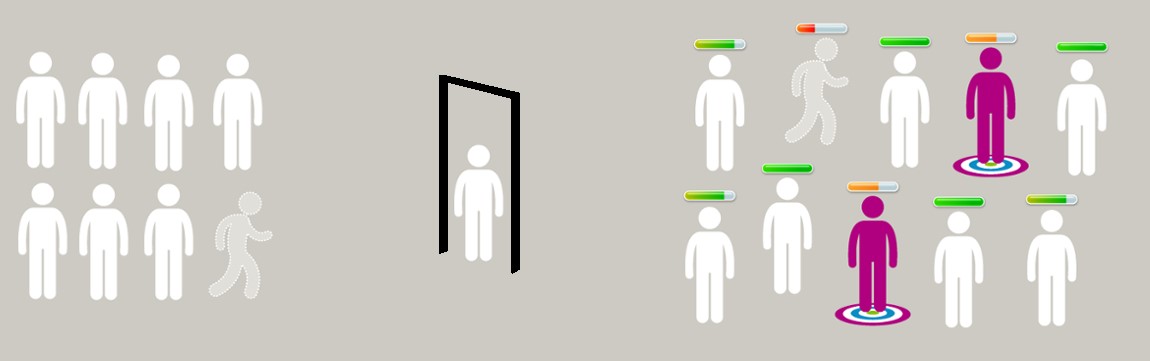

If we combine all these elements, we can use a mix of statistical techniques to deliver a (transparent) predictive model. We can then tag each customer with a likelihood of churn. By setting the right threshold, we can immediately detect the customers we should focus on retaining and thus optimize our retention spend.

How to get started

Please contact us to get started with Churn prediction.