Global Minimum Tax

Global Minimum Tax is an international tax policy initiative aimed at ensuring that large multi-national enterprises (MNEs) pay a minimum level of tax on their income in each jurisdiction they operate. This policy provides an answer to the Base Erosion and Profit Shifting (BEPS) activities of large enterprises. By using tax planning strategies to exploit gaps and mismatches in tax rules, these enterprises shift profits to low or no-tax locations where there is little or no economic activity resulting in the erosion of the tax base of higher-tax jurisdictions.

The Global Minimum Tax policy is part of the OECD/G20 Inclusive Framework on BEPS and is based on the Global Anti-Base Erosion (GloBE) Rules.

Pillar II

In December 2021 OECD released Pillar II Model Rules also known as the GloBE Rules.

Key factors:

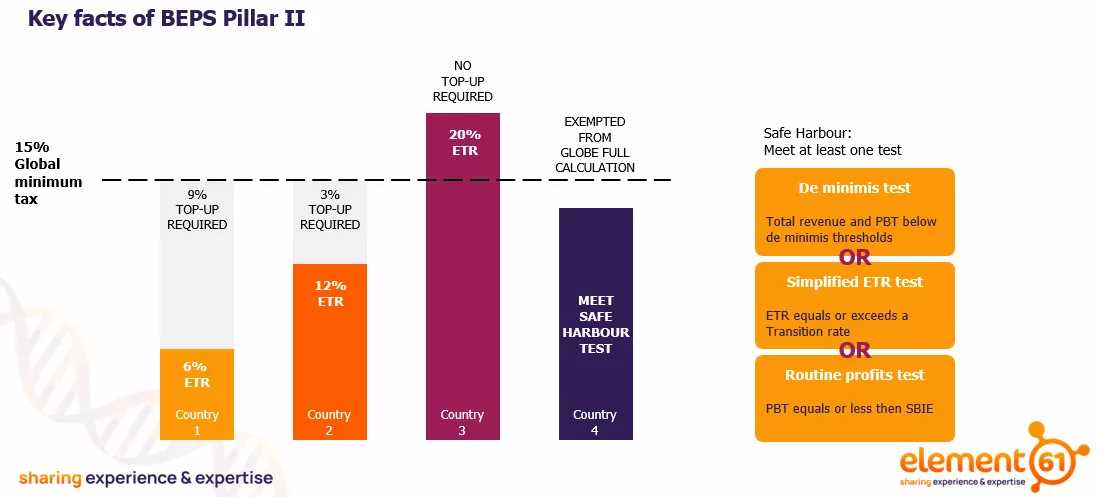

- Minimum Tax Rate: The global minimum tax rate is set at 15%.

- Scope: Internationally operating MNEs exceeding the € 750 million consolidated group revenue threshold for two out of the four fiscal years immediately preceding the tested fiscal year

- Safe Harbour: A short-term measure to exclude MNEs operations in lower-risk countries from the compliance obligation of preparing full GloBE calculations. It comprises three tests to be performed on a jurisdictional level. The jurisdiction needs to meet at least one of these tests:

- Revenue and income below the de minimis threshold (De minimis test), or

- An ETR that equals or exceeds an agreed rate (Simplified ETR test), or

- No excess profits after excluding routine profits (Routine profits test)

- Top-Up Tax: If the Effective Tax Rate (ETR) in a jurisdiction is below 15%, a top-up tax is imposed to bring the total tax on profits up to the minimum rate.

- Jurisdictional Basis: MNEs calculate their income and taxes on a jurisdictional basis to determine if a top-up tax is required.

- Substance-Based Income Exclusion: Certain income may be excluded from the top-up tax calculation to protect MNEs that made substantial investments in personnel and/or assets in a jurisdiction.

Objectives:

Pillar II was developed to restore confidence in the tax system and ensure that profits are taxed where economic activities take place and value is created. It aims to:

- Reduce Tax Competition: By setting a floor on tax rates, the policy aims to reduce the incentive for countries to engage in tax competition by lowering their corporate tax rates.

- Prevent Profit Shifting: It discourages MNEs from shifting profits to low-tax jurisdictions to avoid paying taxes.

- Promote Fairness: Ensures that MNEs contribute their fair share of taxes, regardless of where they operate

Kickstart BEPS Pillar II and CbCR reporting with CCH Tagetik Global Minimum Tax. Click here to find out more or Contact us.