CCH Tagetik Global Minimum Tax

CCH Tagetik Global Minimum Tax is a pre-built expert solution that streamlines BEPS Pillar II data collection, calculations, reporting, CbCR, planning and performance management according to OECD guidance.

By the end of 2024, large multinationals will be expected to comply with the GloBE rules, which will place a heavy administrative burden on them. For those multinationals, CCH Tagetik is the lighthouse that informs, guides and optimizes tax calculations to support the financial close. CCH Tagetik applies a top-down Global Minimum Tax calculation approach by pulling data points from various sources, performing tax calculations, and evaluating the requirements for top-up tax application at the consolidated level. The solution includes the latest GloBE rules as released by the OECD. To give our customers maximum support the OECD 5-step model and the Safe Harbour rules have been converted to a CCH Tagetik Pre-packaged solution. The solution is composed of a standardized process, including workflow, data processing and forms.

CCH Tagetik GMT solution covers the following steps in the reporting cycle

- Data collection & calculations. The application facilitates collection of data and metadata from different sources (tax, finance, HR, etc.) and mapping them to data points, while allowing data review to assure data quality and consistency. The application automatically calculates top-up tax using the Tagetik rules engine and multi-dimensional calculations and allocates tax amounts to impacted entities.

- Reporting & CbCR. The application prepares a CbCR report as well as a GMT report according to the GloBE Information Return (GIR) as required by the OECD.

- Planning & performance management. With the application you can enhance collaboration, by orchestrating responsibilities, set deadlines, receive notifications, and determine access rights. The application also allows for strategic planning via what-if analyses to understand Pillar II impacts on cash, effective tax rate, and safe harbors, as well as simulating changes to your business to mitigate material impacts and protect funds.

Insight into CCH Tagetik GMT solution process workflows

The CCH Tagetik Global Minimum Tax solution has two pre-built process workflows: one for CbCR reporting and one for GMT reporting.

CbCR Process Workflow

The CbCR process workflow is composed of 4 steps, including Data preparation (setting and verifying initial configuration), Data collection (upload and map data to CbCR data points), CbCR reporting (navigate the standard templates as required by the regulation) and Filing (configuration and generation of the CbCR XML file).

Key CbCR output can be used as a starting point of Safe Harbour tests in the GMT process (see further in this document).

The CbCR Reporting step is the third step of the CbCR process workflow and presents the three templates required by the CbCR regulation, a summary dashboard, the Public CbCR report and the KPIs obtained with the data from Template 1.

TAB1 – Template 1

This template includes two reports: (1) Overview of allocation of income, taxes and business activities by tax Jurisdiction and (2) Overview of allocation of income, taxes and business activities by tax jurisdiction detailed per Entity

TAB2 – Template 2

This template presents a list of all constituent entities of the MNE group included in each aggregation per tax jurisdiction. In this report, it is necessary to define the relevant business activities for each Entity.

TAB3 – Template 3

The purpose of Template 3 is to collect additional qualitative information related to the activities of the Group during the fiscal year.

Dashboard

This report includes a dashboard that is fully customizable depending on your needs.

Public CBCR

This report shows the data from Template 1, according to the grouping required by the Public CbCR regulations.

Task Risk Assessment Reports

Three different reports are included:

These reports show the data from Template 1, according to KPIs, gained from the OECD manual: Handbook on Effective Tax Risk Assessment.

GMT Process Workflow

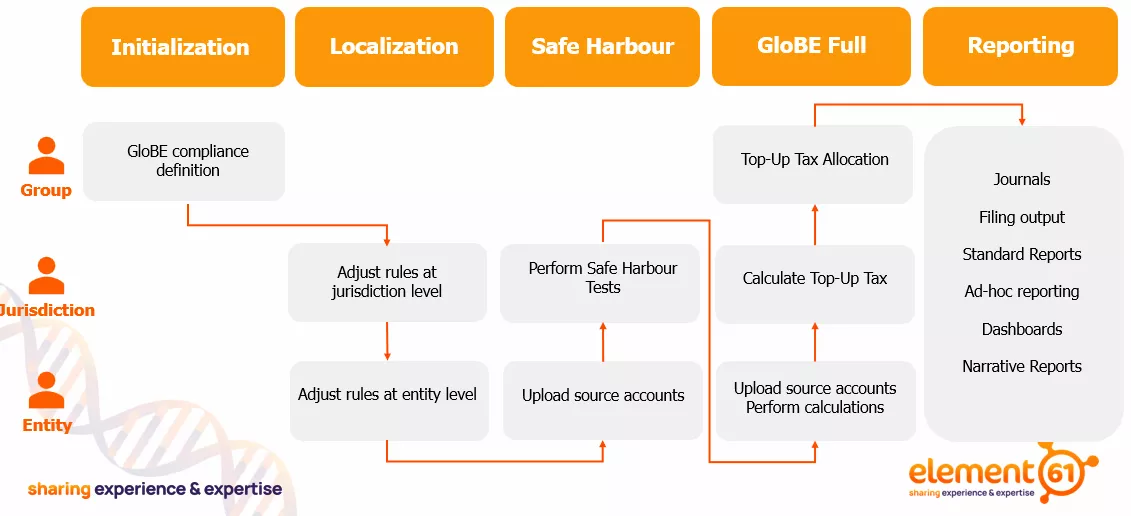

The GMT process workflow is based on the OECD 5-step model and Safe Harbour rules. The process workflow consists of 5 steps:

Initialization – Localization – Safe Harbour – GloBE Full – Reporting

Next to these 5 steps there are 3 levels on which data can be reported: Group level, Jurisdiction level and Entity level. Not all levels are applied in every step.

Initialization

Initialization determines the scope: which entities can be excluded, which should be included, and which jurisdictions are involved.

In this first step of the process, several configurations are managed like: Initial solution configuration, Jurisdiction configuration, Entity configuration, Ownership interest definition and Pillar II rules definition. These configurations can be performed by using predefined ETL upload files or directly into the system. Besides, some information, like the Ownership interest definition, can be extracted from Ownership Structure Register used in Tagetik Consolidation process.

The solution comes with a framework in which the Pillar II Model Rules have been defined. Rules can be managed and adjusted if needed. This can be done at Group level in this Initialization step but also at Jurisdiction and Entity level in the next step: Localization.

Localization

Localization allows local administrators to choose and set up relevant configuration and elections for their jurisdiction. In the localization step, administrators can customize the standard rule configuration and meet specific requirements at a local level. Adjustments to the rules can be made on a Jurisdiction level and Entity level, depending on the requirements.

Transitional Safe Harbour

Based on the CbCR report and financial accounting data, this step verifies if there are jurisdictions passing one of the Safe Harbour tests (De minimis test, Simplified ETR test or Routine profits test), and can be excluded from the compliance obligation of preparing full Pillar II calculations. The Safe Harbour tests are performed at Jurisdiction level.

Data can be uploaded via the first three tasks. This includes uploading source accounts and mapping them with GMT data points. This can be done via predefined ETL upload files as well as via CbCR mapping, which allows you to upload the mapping between the CbCR filing elements and the GMT data points. Afterwards data can be verified and adjusted in the “Safe Harbors Data Check and Adjustment” task.

The “Safe Harbors Calculation and Results” task provides you with Safe Harbour test results. In the example below you see that Italy did not pass any of the Safe Harbour tests and hence will need to go through the GloBE full calculation.

GloBE Full

If a jurisdiction does not comply with the Safe Harbour it needs to follow the complete GloBE rules.

This step allows you to determine if all entities and jurisdictions are compliant with these GloBE rules and to calculate and allocate the top-up tax.

Entity level

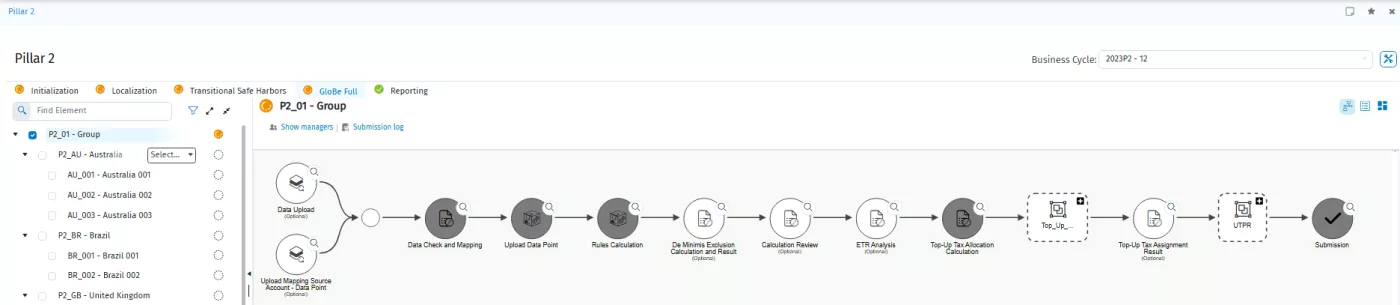

The first part of the GloBE full rules is to determine the GloBE Income and Adjusted Covered Taxes per entity. We apply a bottom-up approach and start with the entities before moving to the jurisdictions and group.

For the first two tasks, data for this entity has already been uploaded in the Safe Harbour step and does not need to be repeated. The same applies for the task “Data mapping” but it can still be used to review. After running the “Upload Data Point” task, data can be checked and reviewed via the eponymous task.

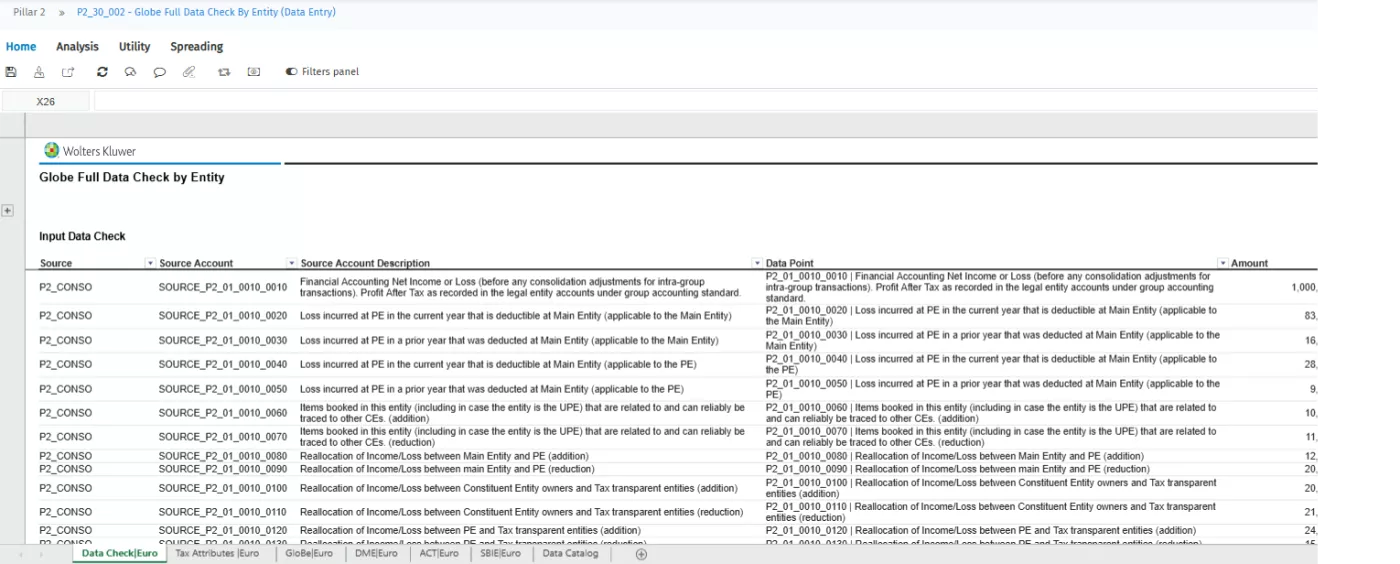

The “Data Check and Review” report includes several tabs providing results on mapping, the link between source accounts and data points with their related amounts, as well as data that has been uploaded to feed the fiscal details required for the calculations of the Tax Attributes, GloBE Income, De Minimis Exclusion, Adjusted Covered Taxes and the SBIE (Substance Based Income Exclusion).

After running the “Tax Adjustments Calculation”, the “Calculation review” shows the result of the data load, data mapping, adjustments and data processing. This report provides a summary of all active rules, next to the calculated GloBE income (see example below), Adjusted Covered Taxes and SBIE.

Jurisdiction level

The second part of the GloBE full rules is to determine the top-up tax per Jurisdiction, allocate this to the Entities and eventually to the Parent entities.

The first tasks have already been covered in previous steps. The “Net GloBe Calculation Review” report provides an overview of the Financial Accounting Net income, via adjustments to the GloBe Income for each Entity in the Jurisdiction.

“De Minimis Exclusion Calculation and Results” report shows you again the result of the De minimis test discussed in the Safe Harbour step of the process. For jurisdictions that did not pass the Safe Harbour tests, Adjusted Covered Taxes need to be calculated via the “Adjusted Covered Tax Calculation” task.

The “Calculation review” report gives an overview of the Globe income or loss, Adjusted Covered Taxes and the SBIE data for each entity in the jurisdiction.

In the “ETR Analysis” task the ETR of the related jurisdiction is calculated and presented by subgroup (Normal Constituent Entities (CE), Minority-Owned Constituent Entities (MOCE) and Joint Venture (JV)).

In the next task “Top-Up Tax Calculation” the top-up tax per subgroup is calculated and presented. The second tab of the report shows the top-up tax by entity.

Group level

The last part of the GloBE step deals with the Top-Up Tax allocation applied at Group level.

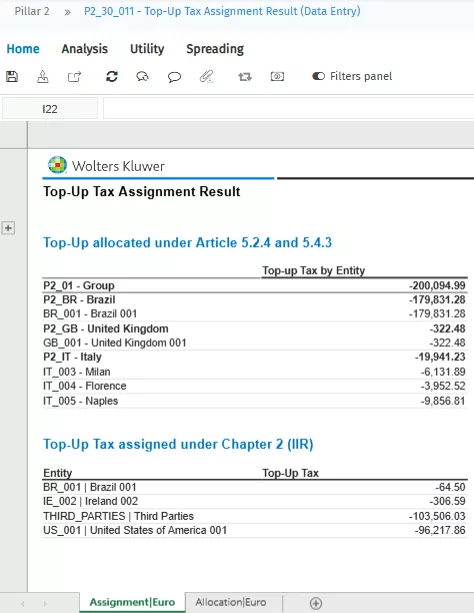

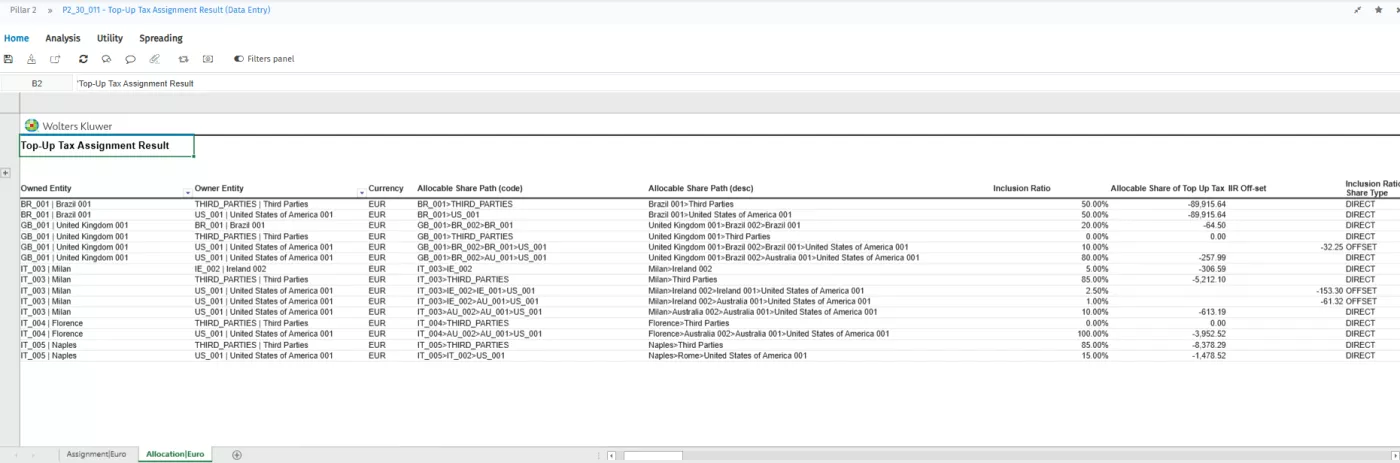

After running the “Top-Up Tax Calculation” task (the other tasks are not necessary as they have already been covered on jurisdiction level), the “Top-Up Tax Assignment Result” report provides an overview of the top-up tax calculated on jurisdiction (or subgroup) level and the allocation to the entities in that jurisdiction.

The second tab of the report deals with the allocation of the top-up tax to parent entities with an ownership interest in the low-taxed constituent entities based on the Income Inclusion Rule (IIR).

Reporting

This step will create output reports for review. It also creates a draft that can be used as input for the GloBE Information Return (GIR). This step is only applicable at Group level as Pillar II reporting is done at group level. It presents a General Overview and MNE Group Information.

The General Overview can be used to monitor the status of the Pillar II process and is typically set up as a dashboard. It presents general relevant data like the total amount of the top-up tax, number of constituent entities and number of jurisdictions. It is also easy to retrieve information like the distribution of the top-up tax between the jurisdictions, the value of the ETR for each jurisdiction in comparison to the threshold of 15% and the amount of the adjusted covered tax and the top-up tax by jurisdiction.

The MNE Group Information presents the first part of the Global Information Return (GIR). It presents general information about the MNE group, corporate structure, filing constituent entity, general accounting information and a general summary.