Are we on the eve of a breakthrough for predictive analytics within the Office of Finance?

Will covid19 speed up embracing predictive analytics supported

& automated forecast and budget reporting?

Contribute to the success of the business, act as the trusted advisor to the CEO,… are some of the credo’s that CFO’s try to live up to over the past couple of years.

Despite all efforts and a strong desire from the Finance teams to match these expectations, realizing impact is hard, surely in a traditional Finance practice with a "doing-things-the-way-they’ve-always-been-done" mantra.

Will the current economic crisis with increased uncertainty and high volatility unlock the business potential of the finance departments?

For sure the ability to quickly assess your company’s ‘whereabouts’ and the capability to swiftly respond to upcoming business threats or opportunities will be a key competitive advantage over the coming months and years. Successful business agility will not last unless it is supported by a Finance function, capable of delivering agile forward-looking insights.

That’s where Predictive Analytics may come into play. Predictive Analytics look forward in an attempt to anticipate unknown future events or actions based on historical data, statistical modelling and machine learning techniques. Over the last years, predictive analytics has become more and more mature and acknowledged. Predictive data use cases such as optimization of marketing campaigns, improving inventory management or detecting fraudulent payments are popping up within the sales, marketing, logistics and maintenance departments.

The Office of Finance seems to be lagging. Within finance, often perceived as cautious and wary of new techniques, the typical IT systems supporting the planning cycles are falling short. Too often still, finance is struggling to embed what-if analysis and scenario planning within the business analysis they deliver. For sure in an economic climate where time is of the essence, the predictive business analysis will be sacrificed to be able to produce prompt reporting and analysis, often just on "past" data.

Nonetheless, Predictive Analytics can bring value to the Office of Finance, even without the need for finance people to become experts in statistics.

In times when swift forward-looking insights are crucial any breakthrough within the process of repeatedly composing or updating -in an automatic way- the forecasts seems welcome.

Some typical problems with the often cumbersome process of forecasting outcomes can be countered by engaging with Predictive Analytics.

- The forecast process is too time and resource consuming. Finance needs to reach out to business users and corporate leadership, coordinate expectations, adjust when necessary and distil a consolidated forecast from all these inputs, often leading to long lead times.

- The forecast accuracy is often too weak. While the revenue forecast is mostly perceived to be precisely estimated and specified, submitting a forward-looking insight into the different types of indirect cost, the evolution of working capital or the forecasted cash flow… is more ambitious and dependent on much more than merely the estimated sales evolution.

- Financial modelling capabilities are all too often absent. Executives have the desire to simulate business decision impacts and forecast their outcome. Yet in reality, such demands are often addressed by "offline" Excel simulations as the IT systems in place are typically unable to properly cope with these requests.

Predictive Analytics can help to generate future insights and enable any organization to use past and current data to reliably forecast future trends or detect risk and opportunities, as such reducing cycle times and resources costs while increasing swift delivery of critical business insight supporting leadership decisions.

In practise, Machine Learning techniques are used to generate concrete predictions. In response to different business situations, a wide range of predictive models, such as Regression, Classification, Clustering, Anomalies detection,… can be exploited. Each of these types of predictive models is typically used towards a specific context.

Machine Learning algorithms can thus be applied to help us solve different business problems.

Some typical questions where machine learning can be of help are:

| How many? | What will sales be in 20xx for Y | number prediction |

| What category? | What is the likelihood for overdue | class prediction |

| What groups? | What product sell well together | pattern prediction |

| What’s weird? | What region is selling less than expected | outlier prediction |

Based on the historical and present datasets at hand, multiple predictive models can be applied to allow for different types of analyses and predictions which are contributing to the agility of the forecast process.

- With time series analysis, certain variables are tracked based on historic data. An estimate for the future periods can be extrapolated from this historic data. These predictions can easily contribute in the context of forecasting, by automatically prefilling a forecast scenario, proposing default values to the business audience, as such cutting down on the lead time for them to generate their forecast.

- With multivariate analysis, a dependent variable is being predicted based on several other variables. To obtain relevant analysis, econometric methods are used. In that case business logic is required to set up a model defining which variables are driving a dependent variable. An example in forecasting could be to understand how sales are impacted by variables such as price or different types of discounts. Business users may use this type of analysis to help them identify driver dependency or validate dependency assumptions and increase forecast precision.

- With outlier detection, statistical methods are used to find anomalies in the data. A practical use case in forecasting can be to proactively notify business users of deviations within a certain type of cost, price or volume projection. Outlier detection will benefit the overall forecast accuracy.

- In categorical decisions, a yes or no question is answered. Will the customer pay on time, will the intercompany relation reconcile, will the customer churn…? This type of analysis is often sales, marketing or production-related but can be beneficial to the forecast cycle as well. A concrete use case can be bad debt categorization on the projected accounts receivables, based upon historical data on (types of) customers.

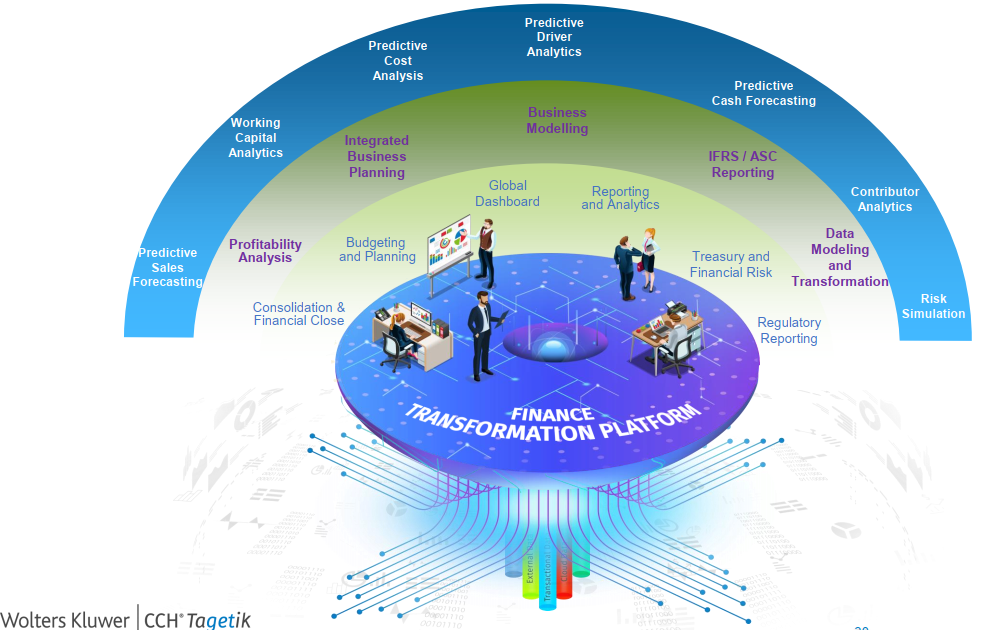

CCH Tagetik is a unified Performance Management software supporting various processes such as forecasting, budgeting, integrated planning, consolidation, modelling and analysis.

CCH Tagetik took on the challenge of embedding Predictive Analytics capabilities into the existing software and allows to add-on predictive analytics functionality from external development environments, also called IDEs or Integrated Development Environments. This allows certain Advanced Analytics scripts (like R or Pyrhon) to be written, tested, developed and executed with data residing within CCH Tagetik.

What’s more, within the CCH Tagetik platform, the Analytical Information Hub has been made available. This Analytical Information Hub is designed to exploit large amounts of granular financial and operational data and is very well suited to be used within the context of Advanced and Predictive analytics. The Analytical Information Hub is an extension of the Tagetik Financial Workspace, which holds the core of the traditional CPM data model, together they are positioned as the CCH Tagetik Finance Transformation Platform.

The Analytical Information Hub houses its own supplementary set of dimensionality to accommodate broader and more granular volumes of data, for example detailed Supply Chain and S&OP Data, as such affording a greater degree of analysis. Moreover, the Analytical Information Hub integrates with advance analytical engines such as a Python or R server,…which can be used to trigger recalculations of predictive models.

Engaging with these predictive models can, in turn, boost the forecast accuracy while limiting the time and resources spent. Furthermore, simulations between data collection within CCH Tagetik’s Analytical Workspace and an advance analytical engine can occur more or less in real-time.

Consequently, there are plenty of possibilities to use these algorithms: sales forecasting, energy usage prediction, scrap prediction, warranty costs prediction, production cost prediction, cash forecasting, outlier detection in forecasting, risk simulation…

Whereas traditional forecasting is a bottom-up process potentially cumulating subjective assumptions from the different layers in the organization, predictive forecast models promote fact-driven forward-looking insights generation. As such Machine Learning can help reduce the manual workload, increase forecast accuracy and enhance financial modelling.

CCH Tagetik is putting Predictive Analytics on the roadmap by groundbreaking work from Professor Controlling Karsten Oehler, Solution Architect @ CCH Tagetik.

In a holistic approach, combining the experience and expertise of our Corporate Performance Management and Data Science competence centres, element61 is helping organisations to navigate into the future by embedding agile automation within their forecasting and planning processes.

If you have any questions regarding Predictive Analytics, AI, integration of this in Planning & Budgeting processes or CCH Tagetik in your organisation, please reach out to us via info@element61.be.