Introduction

With SAP BPC (BusinessObjects Planning and Consolidation), customers can already benefit from one single platform where management reporting, planning processes and financial consolidation are unified.

Next to BPC, there is SAP BFC or SAP BusinessObjects Financial Consolidation. Just a single letter difference, but a second solution supporting the same financial consolidation process. And SAP still supports its own consolidation tool, SEM-BCS (Business Consolidation System).

Whereas SAP BPC and SAP BFC are not natively integrated within the Netweaver landscape - how could it be as both originate from acquisitions (OutlookSoft and Cartesis) – SEM-BCS is SAP’s historical solution for financial consolidation, fully integrated into the SAP Netweaver Business Warehouse (BW) platform.

And finally, next to SEM-BCS residing within the BW landscape, we also still find SAP EC-CS which resides in the ECC system and is also able to perform financial consolidation.

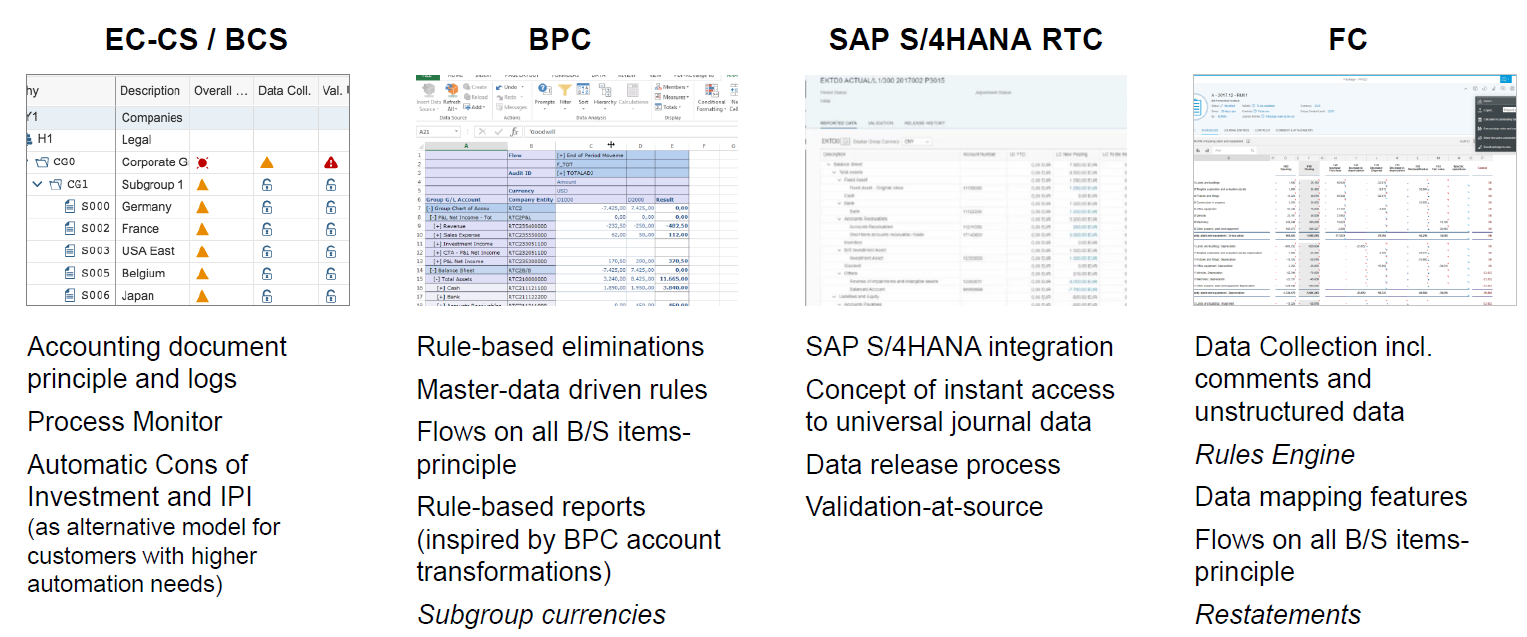

Figure 1 - SAP’s financial consolidation solutions (RTC stands for Real Time Consolidation and represents Group reporting)

Positioning

So back to the starting question. Was there a need for SAP to add yet another product to its financial consolidation product portfolio? Well, maybe. As it is filling the gaps SAP EC-CS and SAP-BCS are leaving in a S4HANA Suite context.

So the wording “yet another” might be misplaced.

The new solution is called SAP S/4HANA Finance for Group Reporting.

It was in May 2017, in the 1705 release - where SAP announced the availability of SAP S/4HANA Cloud for Group Reporting, that we saw the first announcements on the possibility to address statutory financial consolidations. As this product evolved over the next months, SAP decided to have an on-premise version as well and called it SAP S/4HANA Finance for Group Reporting. Both are an integral part of S/4HANA Finance.

SAP S/4HANA Finance for Group Reporting (aka. SAP Group Reporting) is not just another product that supports financial consolidation. It stands on the shoulders of the consolidation solutions that we have mentioned above, SEM-BCS/ EC-CS, SAP BPC and SAP BFC. That should be interpreted somewhat literally. Some key concepts that are being used in SAP Group Reporting have been inherited from those pre-existing consolidation solutions. For example, in Group Reporting the document principle and posting level is based on SAP EC-CS/BCS, the methods and FS item property selections are based on SAP BPC and the data collection features being cloud specific are based on SAP BFC.

It uses SAP Universal Journal as a single source of truth (ACDOCU). The universal journal is the basis of an integrated accounting system combining general ledger accounting, asset accounting, controlling and material ledger. S/4 HANA customers with a need for financial consolidation can benefit from this integrated approach and move away from disparate financial data silos that have the following consequences:

- Insufficient accounting details, such as details on intercompany transactions, missing from the data or details on asset movements to automate fixed asset schedules

- Opaque data mapping from operational details to aggregated group structures

- Data available to business analysts on group level is limited to their highly aggregated, mapped data lacking the possibility to drill down to operational details and preventing the use of advanced automated analysis

- Many back-and-forths between group and subsidiary to ask for additional details

- Data that is populated incorrectly according to local vs. group rules

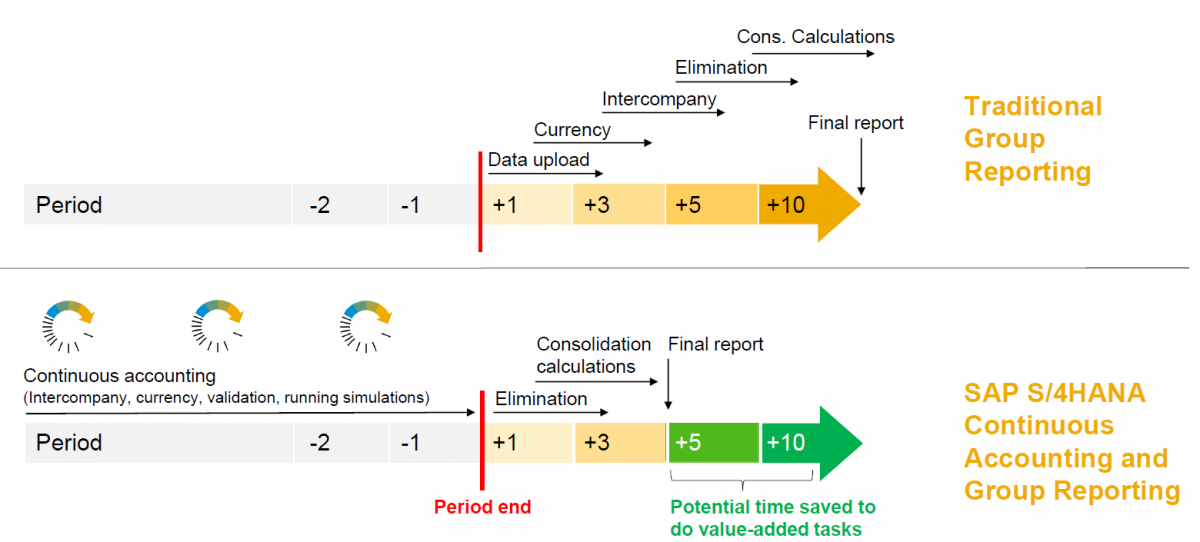

SAP S/4HANA Finance for Group Reporting can eliminate these substantial challenges and provide more automated, faster and accurate financial reporting. From a continuous accounting perspective, this new consolidation solution allows starting the consolidation process alongside the local accounting close, as such eliminating the traditional closing waterfall approach and engages in a more continuous approach of financial reporting where some consolidation tasks can be done prior to the period end close. Entity close and group close are converging for the next generation of consolidation solutions in terms of speed and quality of closing.

Figure 2 - Traditional close vs SAP Group Reporting based close

What does this mean for SAP’s other consolidation solutions

The question that arises now is how the new SAP Group Reporting solution will impact the current financial consolidation solutions that SAP has in its portfolio. Will SAP BPC and (B)FC be discontinued?

There are currently no indications that this would be the case for a significant number of years to come. Customers that have done investments or are doing investments in SAP BPC or SAP (B)FC will continue to benefit from their existing solution. Both solutions also have their own SAP roadmap which demonstrates that they still get development attention. However, it is clear that SAP’s program/ambition to move all their customers to S4/HANA in the coming years may give the new kid on the consolidation block a boost.

Currently, SAP Group Reporting is more relevant for a new S/4HANA Finance customer or a customer that has decided to migrate to S/4HANA Finance with a financial consolidation requirement. For those customers, it is interesting to evaluate SAP Group Reporting and compare it to its alternatives. Let it be clear that there is no general answer stating that all financial consolidations requirements must be answered with SAP S/4HANA Finance for Group Reporting moving forward. Various criteria are in play and need to be carefully assessed by the customer.

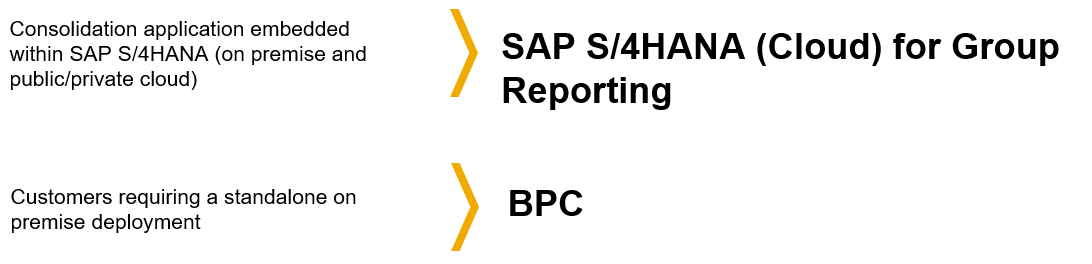

SAP’s statement on financial consolidation is that SAP S/4HANA Finance for Group Reporting is its strategic consolidation solution moving forward, specifically for customers implementing SAP S/4HANA irrespective of deployment option (cloud or on-premise) as well as for customers looking for a public cloud stand-alone offering. It is interesting to know also that SAP Group Reporting can be used independently from operational accounting or other ERP functions in SAP S/4HANA if desired. Customers requiring a stand-alone on-premise deployment can continue to rely on the mature BPC solution SAP BPC 11, version for BW/4HANA.

It is also obvious that the solution is still young and its functionality and capabilities are growing rapidly.

Individual customers are advised to evaluate the possibilities of SAP Group reporting for their context, timeline, SAP strategy and their specific requirements.

Figure 3 - SAP BPC vs SAP Group Reporting

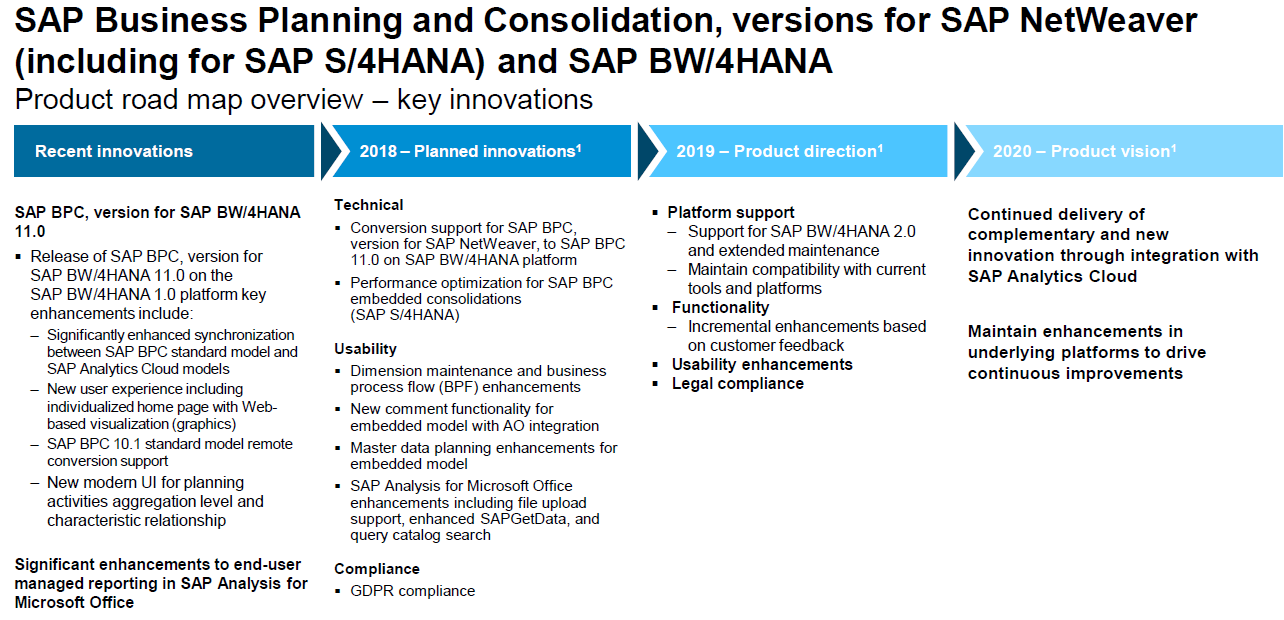

SAP Business Planning and Consolidation (BPC) continues to be a key part of SAP’s Business Analytics portfolio, specifically for those requiring an on-premise planning application.

Reasons for requiring an on-premise application include:

- Regulatory requirements related to the location of data storage

- Corporate policy or contractual agreements

- Ability to deliver deeply integrated planning capabilities as an integral component of an on-premise SAP data warehouse

- Requirements for customization beyond the scope of a public cloud solution

- Requirements for a unified solution combining consolidation, management reporting and planning

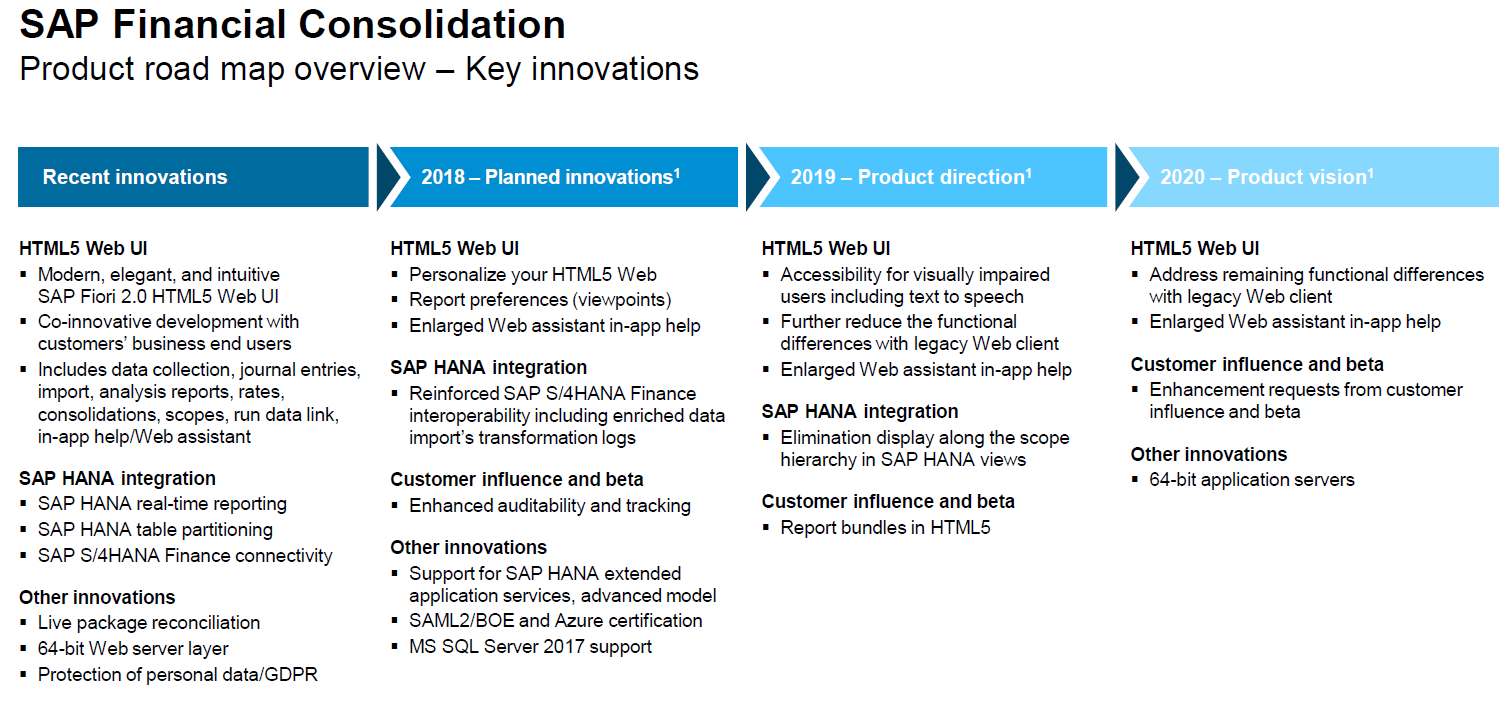

Figure 4 - SAP BPC Roadmap

SAP BusinessObjects Financial Consolidation also continues to evolve. SAP has always positioned SAP BFC as the financial consolidation solution to meet complex consolidation requirements, however SAP BPC can deliver the same functionality. We don’t have the ambition in this article to highlight the differences, we already have done that in a previous article "SAP’s EPM offer, a comparison of SAP BPC and BFC", but the reason why they coexist should be found more in the historical commercialisation and regional coverage of both tools. SAP BFC’s developments will focus on the HTML5 web user interface and the SAP HANA integration.

Figure 5 - SAP BFC Roadmap

SAP EC-CS and SEM BCS have already been put in maintenance mode. These products will only receive the necessary updates in order to be compliant with the latest technology.

But it is clear that with the release of S/4HANA, these products are no longer part of the SAP suite and will be replaced by SAP Group Reporting.

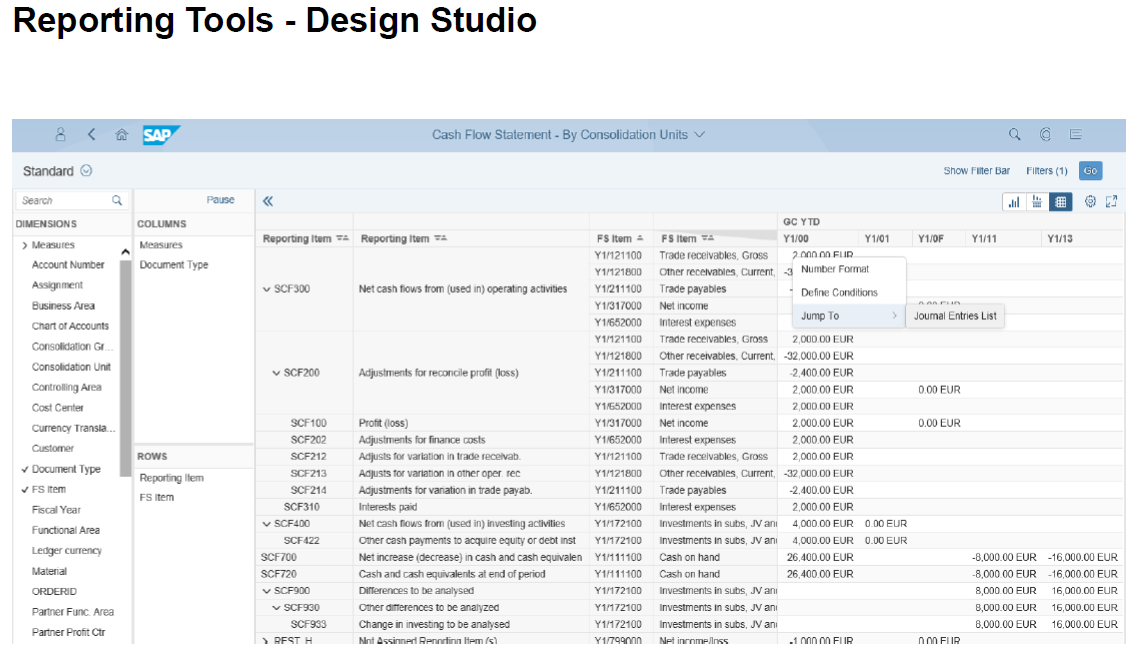

Reporting

SAP BPC customers have always been a big fan of the reporting part within BPC. The BPC EPM plug-in in MS Excel allows customers to consume their data in a very flexible way. The EPM reporting wizard with its vast amount of reporting options and features can answer any reporting need and facilitates the users in fast ad-hoc reporting. With SAP S/4HANA Finance for Group Reporting, the SAP Analysis for Office add-in can be used to consume and analyse the data. Standard, 3 reporting cubes are delivered:

- Group Reporting Data Cube

- Enhanced Group Reporting Data Cube

- Group Journal Entries Cube

The Enhanced Group Reporting Cube includes the reporting rules. Reporting rules define how reporting items are derived. The use of reporting rules enables flexible data selection and structuring of data into report rows or columns in various reports, such as cash flow statement, statement of changes in equity, statement of comprehensive income, and P&L by function of expense.

The reporting experience will be slightly different. Where BPC uses the EPM reporting wizard, Group Reporting uses Analysis for Office queries and crosstabs. Cell based formulas will also be possible to use as well as sending textual information (comments feature). In short, finance departments most favourite MS Excel based reporting environment will also be fully supported by SAP Group Reporting.

Conclusion

It is clear that SAP, with the deployment of S/4HANA Finance and the expected wave to move to the cloud, has good business reasons to offer a native cloud consolidation solution within the S/4 landscape. This is exactly what SAP Group Reporting is delivering and it can be deployed both in cloud / SaaS or as an on-premise solution. Companies with a financial consolidation requirement and looking to migrate to or start on S/4HANA, should certainly look into this solution. Major benefits can be realized when a significant amount of data is being sourced from the universal journal. Make sure to list all relevant criteria what you as a customer expect from your financial consolidation solution in order to make the right choice for your timeline.

Some key take-aways from the Group Reporting solution are:

- Part of S/4HANA Finance cloud or on-premise, designed for group reporting and financial close

- Permanently reconcile financials leveraging S/4HANA universal journal (drill-down / drill-through capabilities) enabling real-time consolidation

- Unify your local close and group close

- Collect data from SAP and non-SAP systems

- Use a complete set of consolidation features available either on cloud or on-premise

Last but not least, with respect to SAP BPC, this is a mature, fully-functional planning and consolidation application utilized by thousands of customers. It continues to be supported and maintained so customer investments are secured. It is also very important to keep in mind that SAP BPC can also fully support your planning process. When adopting SAP Group Reporting, you will still require SAP BPC or SAP Analytics Cloud to support your planning cycle.

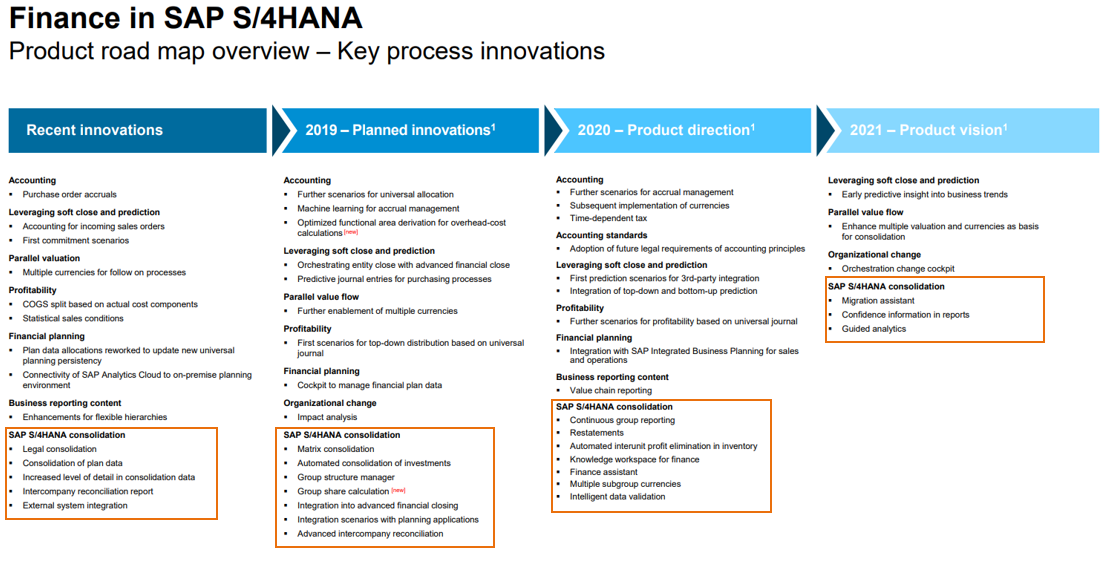

Figure 6 - SAP S/4HANA Group Reporting Roadmap

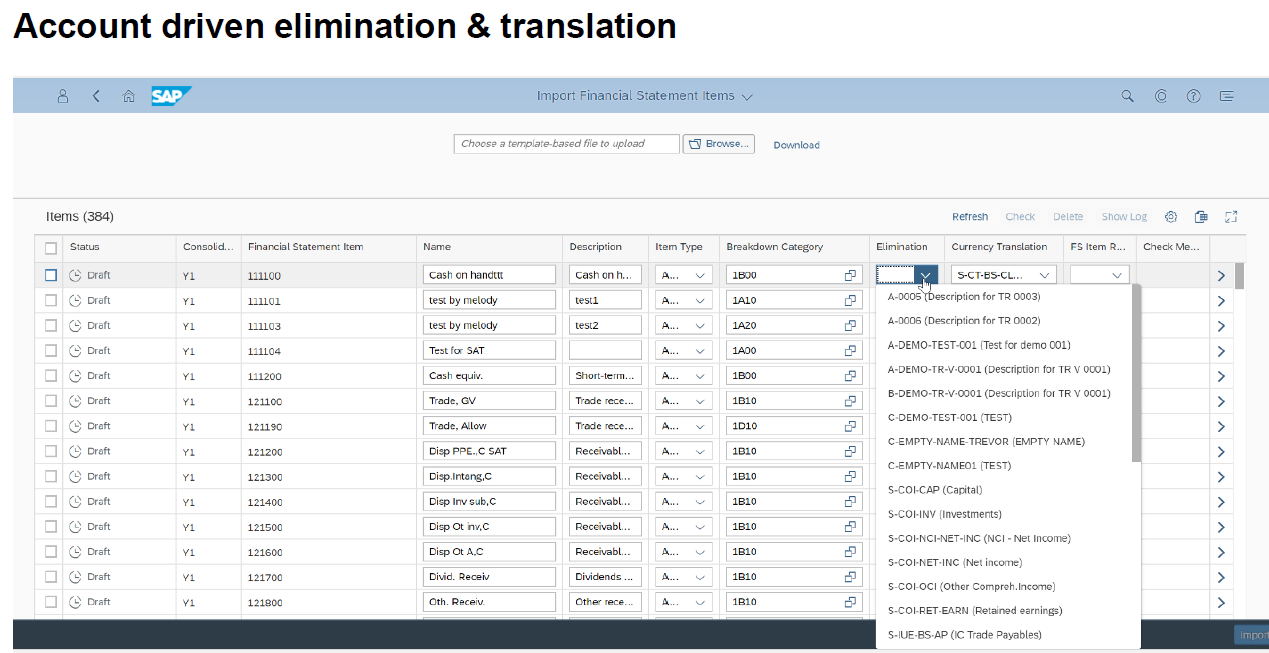

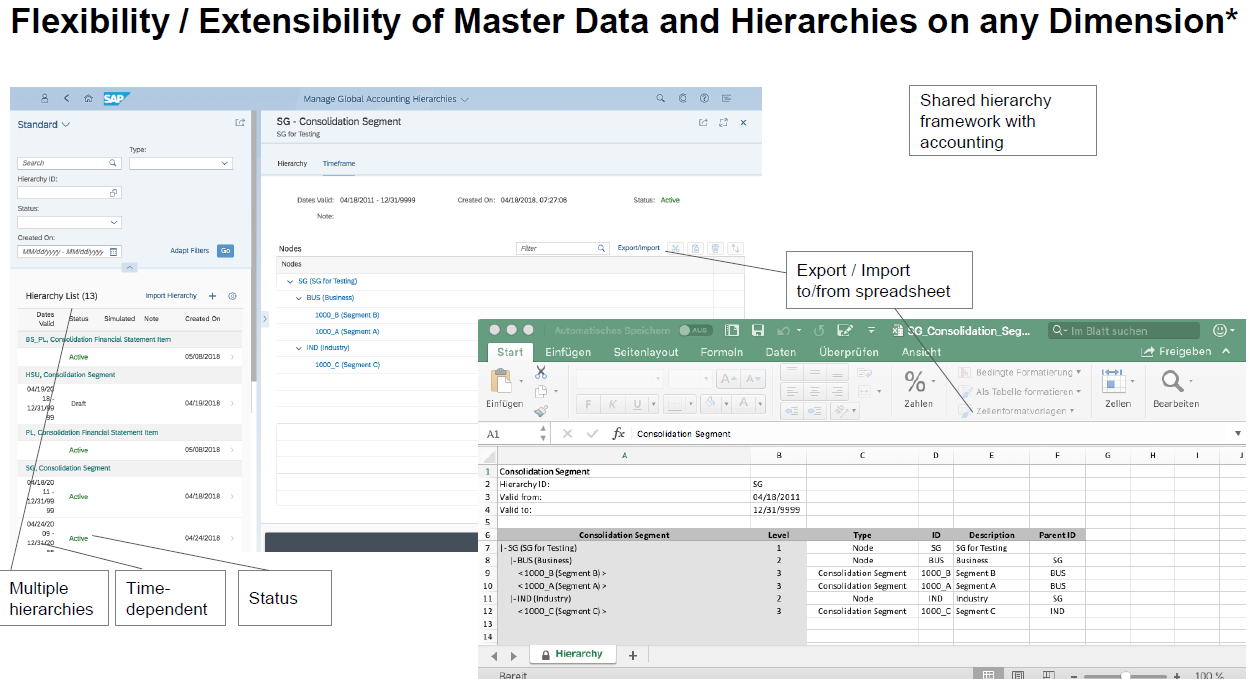

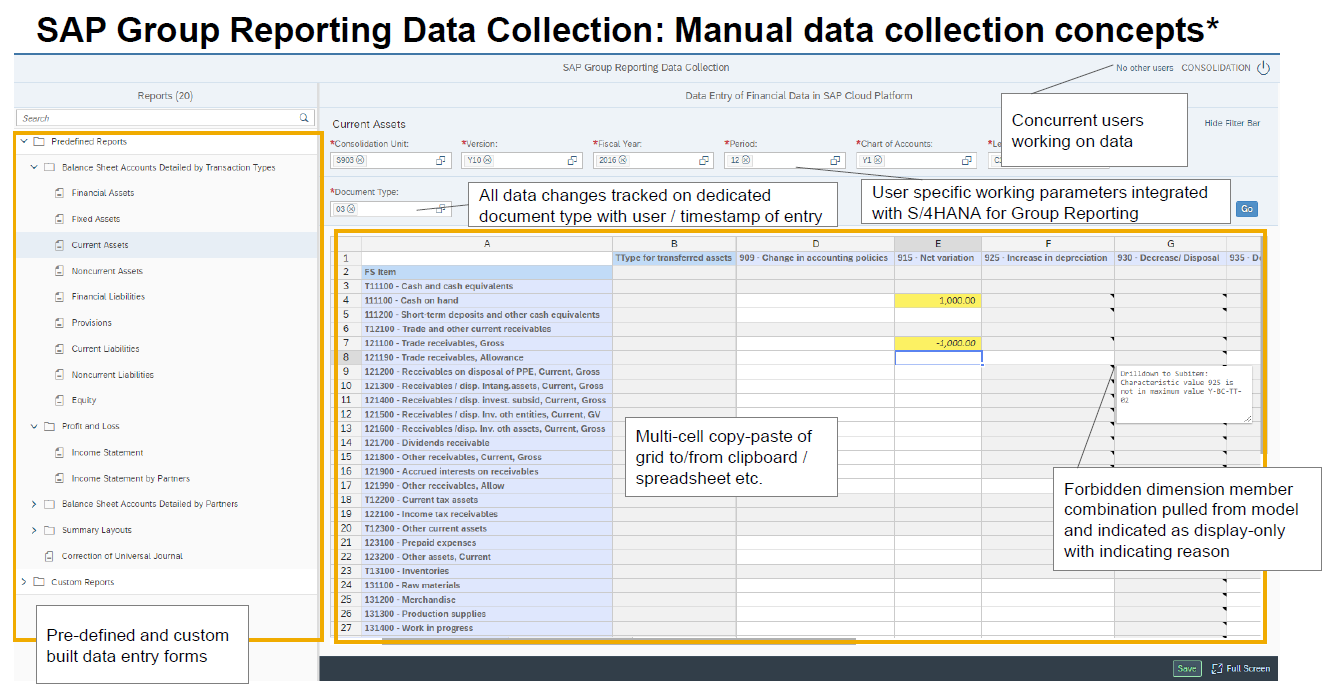

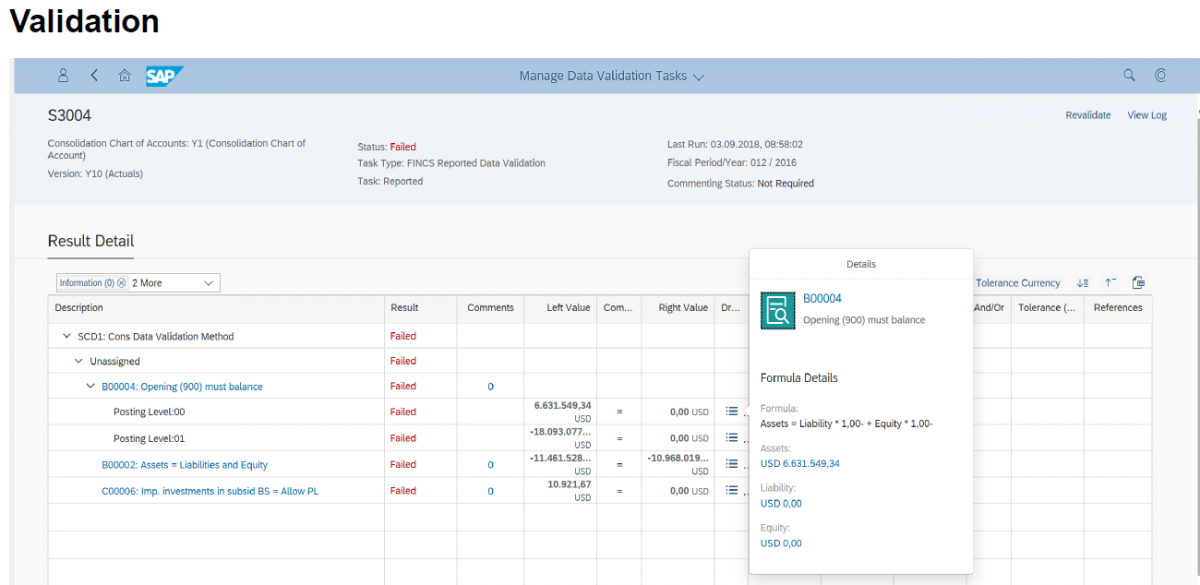

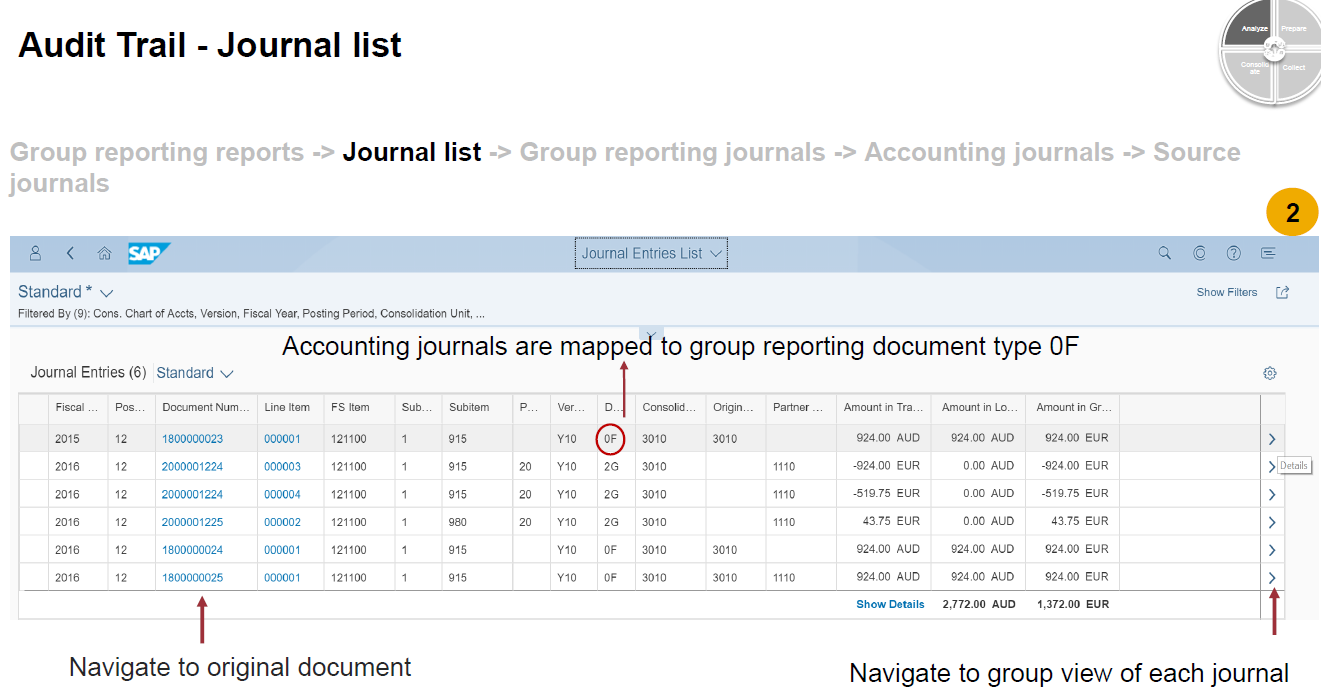

Additional screenshots of SAP S/4HANA Group Reporting

Figure 7 - Account driven elimination and translation

Figure 8 - Master data in SAP Group Reporting

Figure 9 - SAP Group Reporting Data Collection

Figure 10 - Validation rules in SAP Group Reporting

Figure 11 - Journals in SAP Group Reporting

Figure 12 - Reporting in SAP Group Reporting

More information

For more information, contact us!